pouvez-vous me donner un meta description pour un blog automobile

Actualités automobiles

Sortie en famille : pourquoi préférer la location d’un van de luxe ?

Pour de nombreuses familles, planifier une sortie ensemble est une occasion spéciale de créer des

Stage de pilotage Extrem car events

Vivez l'adrénaline au volant d’une voiture puissante sur un circuit légendaire ! Un stage de

Conduire son entreprise de taxi vers le succès avec un site web incontournable

L'importance de la numérisation dans le secteur du taxiAujourd'hui, l'importance de la numérisation dans notre

Zoom sur les nouvelles tendances de covering auto pour sublimer votre véhicule

L'industrie automobile en constante évolution, les tendances actuelles vont bien au-delà de la simple peinture

Permis moto accéléré : comment se déroule cette formule rapide ?

Présentation de l'articleVous fantasmez à propos de la sensation du vent dans vos cheveux tandis

Le guide ultime du vitrage teinté pour votre Golf 7

Présentation de la Golf 7La Golf 7, dernière-née de Volkswagen, est un véhicule compact facile

Conseils d’entretien

Comment détruire légalement sa voiture ? Étapes à suivre et documentations requises

Il existe de nombreuses raisons pour lesquelles vous pourriez avoir besoin de détruire votre voiture.

5 méthodes efficaces pour enlever le lettrage sur la carrosserie de votre voiture

Un lettrage ancien, une lassitude des dessins collés sur la carrosserie de votre voiture, ou

Personnalisez votre auto avec style grâce au flocage voiture design

Brève histoire de la personnification des véhiculesDepuis l'époque où Charlton Heston parcourait les plaines dans

Comment le film covering peut transformer l’apparence de votre véhicule

Dans cet univers automobile en constante évolution, de nouvelles tendances et technologies font constamment surface.

Tuning

Le covering carbone : un relooking high-tech pour votre voiture

Vous cherchez un nouveau moyen de donner un aspect attrayant et luxueux à votre voiture,

Quelle est la meilleure voiture fast and furious ?

Quelle est la marque de la meilleure voiture fast and furious ? La marque de la

Essais et critiques

Le guide complet des services de navettes aéroportuaires à Paris

Dans le rythme effréné de la vie moderne, le transport aéroportuaire efficace et fiable est

Top 5 des voitures les plus économiques en carburant

Présentation du sujet : la consommation de carburantDans le contexte actuel de sensibilisation à l'environnement

Technologies automobiles

Boostez votre expérience VTC : le guide ultime des accessoires

Définition du VTC et de son importanceLe Véhicule de Transport avec Chauffeur (VTC) a connu

Des récits de transformations spectaculaires grâce au covering auto

Définition du covering autoLe covering auto, aussi connu sous le nom de wrapping de voiture,

Voiture à hydrogène : comment ça marche ?

Les voitures à hydrogène sont une technologie de pointe qui offre des avantages considérables en

Arnaques auto : le CEC alerte contre la vente de véhicules inexistants

À la suite de multiples plaintes de consommateurs arnaqués sur eBay, LeBoncoin, Autoscout 24, ou

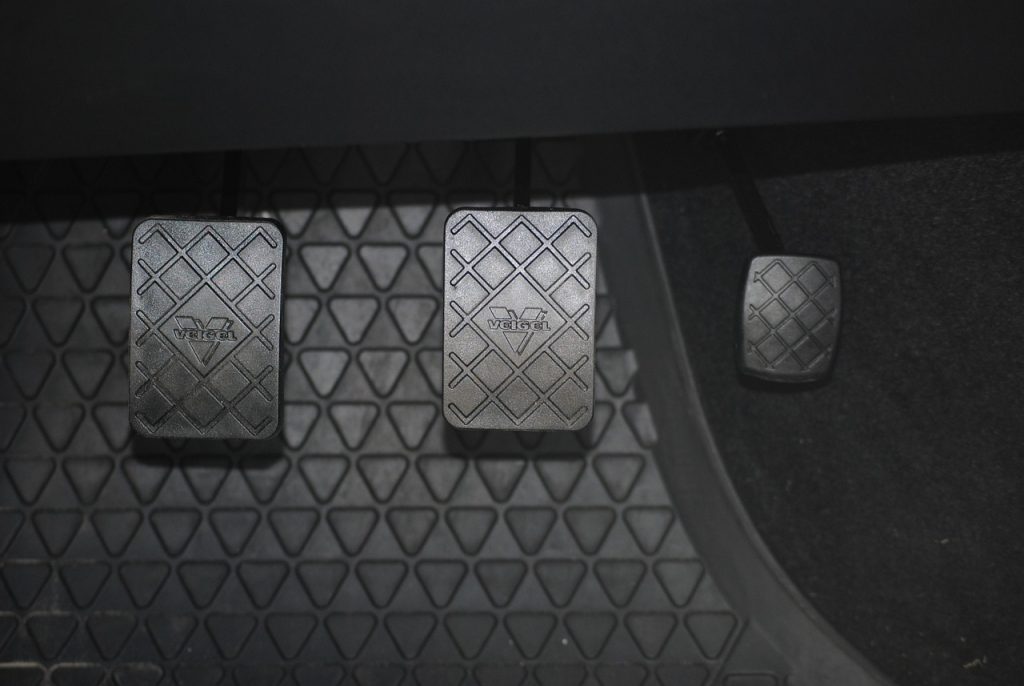

L’essentiel à retenir sur le changement d’embrayage d’un véhicule

Le changement d’embrayage est l’une des nombreuses opérations de routine à effectuer sur un véhicule.

Quels sont les avantages d’une voiture hybride non rechargeable ?

Quelles sont les caractéristiques principales d'une voiture hybride non rechargeable ? Les voitures hybrides non rechargeables